Why Every Student Needs a Financial Roadmap Before Starting Their Career

We tend to remind students to dream big, pick a major they love, and set off on their journey to adulthood with enthusiasm. Here's the truth, however: passion is not enough to prepare for what lies ahead.

From loans to rent, groceries, transportation, and surprise expenses — the

first paycheck often seems stretched thin before the month even starts.

That's where financial planning tools for students become more than nice-to-

have; they're a necessity.

The Problem: Students Make Big Decisions Without Clear Numbers

Each year, students choose majors, cities to reside in, and even professions — sometimes without realizing therealistic salary progression and true cost of living associated with each. Classic budgeting software is not designed for this phase of life. It presumes income and expenses are established. But for students and recent graduates, the future is still being determined.

That's where SPENDiD Cloud comes in.

What is SPENDiD Cloud?

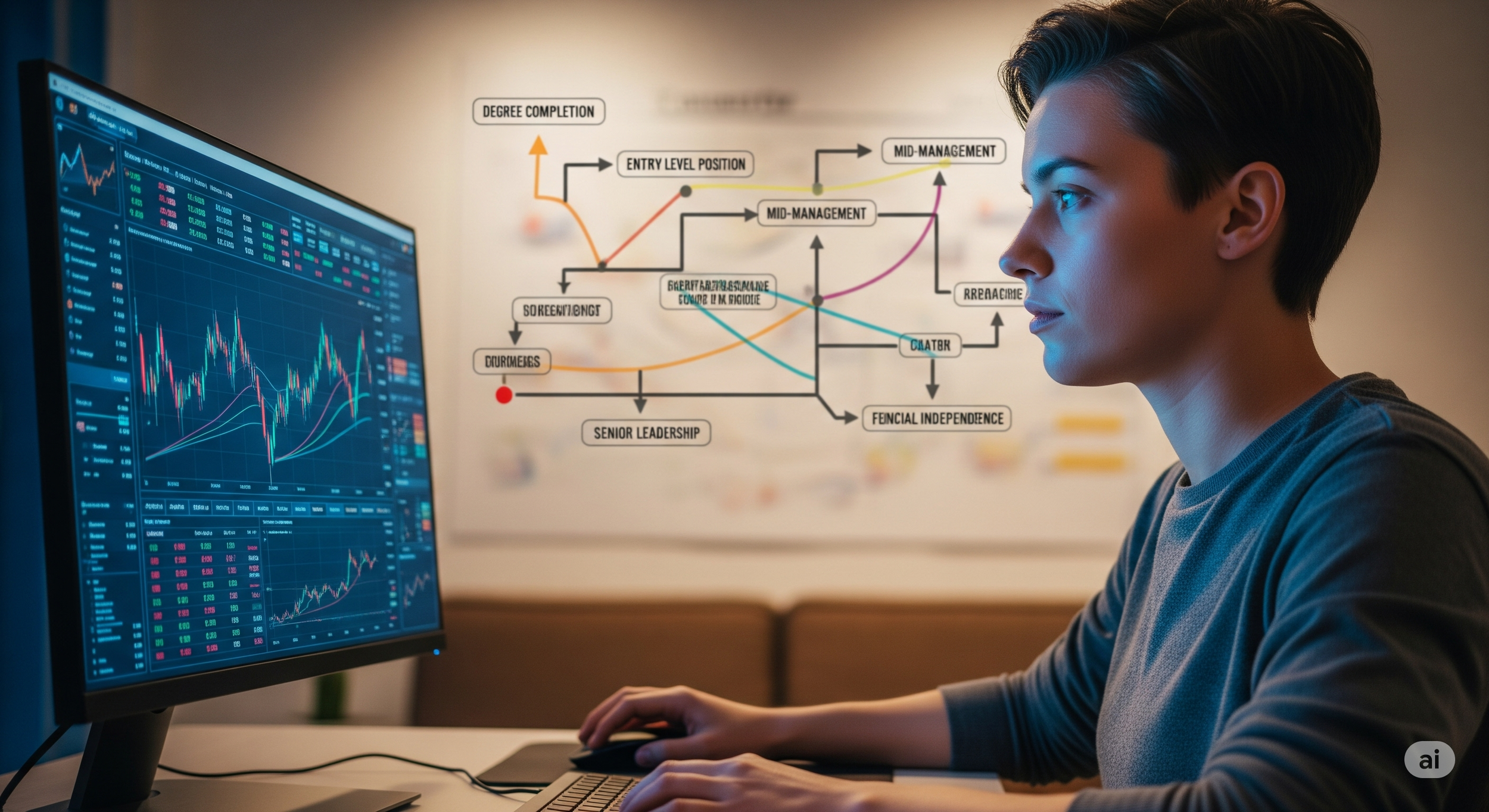

SPENDiD Cloud is not just a budgeting application. It's a career-committed financial projection that teaches students to visualize how today's decisions create financial security down the road.

With SPENDiD Cloud, students can:

Estimate what their first salary will be after taxes.

Compare the cost of living in various cities.

Visualise their potential monthly cash flow before committing to loans or signing leases.

Understand where expenses such as student loans, rent, and transportation fit within the larger picture.

In essence, it's a post-graduation cost of living calculator that brings the abstract into reality and gives way to smarter decision-making before mistakes are made.

Why It Matters: Budgeting Is About Safeguarding Dreams

Budgeting is not about restricting opportunities; it's about safeguarding them.

A student who understands the realities of their future career supporting their lifestyle expectations won't be caught off guard by financial pressure. Rather than stressing over rent or loan repayment, they'll be able to focus on gaining skills, performing well to advance in their career, and living independently.

This type of financial wellness resource doesn't just touch the bank account. It aids mental health, career fulfillment, and long-term security.

The Perfect Gift for Students

Here’s where parents come in. If you’ve ever said, “I wish my child had a clear picture of what life after school will really cost” — SPENDiD Cloud is that picture.

It's a present for their future. Rather than passing along another spreadsheet or speech about "being careful with money," you can provide them with a simulation tool that places the numbers squarely in front of them — easy to see, easy to understand, easy to explore and actionable.

SPENDiD Cloud can be used by parents to initiate open discussions with their children concerning budgeting, career preparedness, and financial empowerment. It's the type of gift that won't dwindle after a season but encourage success throughout the years.

Final Thoughts

Financial literacy is as crucial in the modern world as academic preparation. Students are owed tools that don't just prepare them for the workplace, but for life.

SPENDiD Cloud fills the gap between passion and reality — enabling students to make confident, informed decisions about their future. And for parents, it's a thoughtful way to support their child's journey to adulthood.

Discover SPENDiD Cloud today and learn how it can lead students to a future where dreams and financial security go hand in hand.